General Information

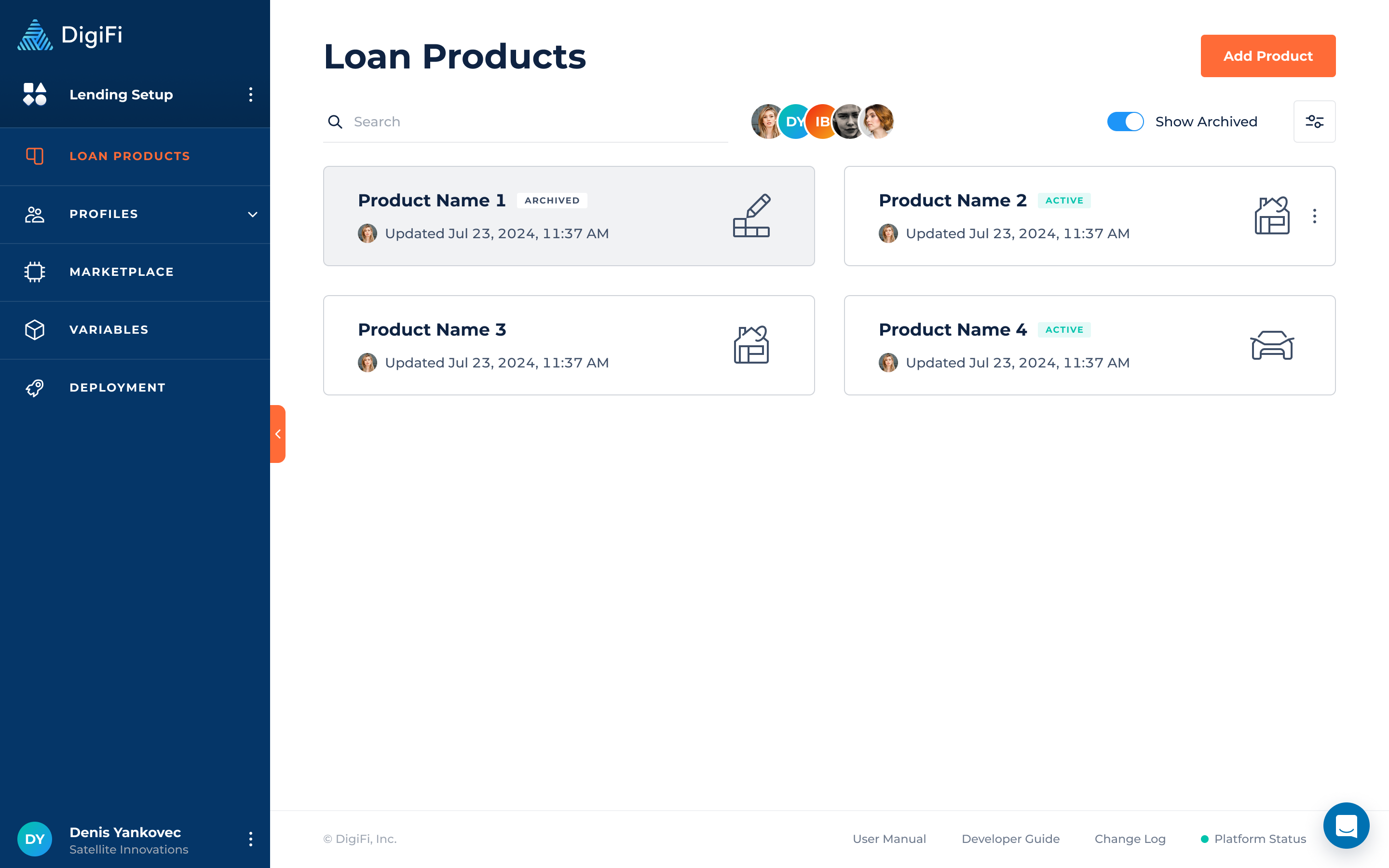

How to manage your loan products in the DigiFi platform.

Introduction to Loan Products

Loan products control the workflow, data layouts, automations and all other aspects of applications within DigiFi's platform. They are highly configurable, allowing different lenders to implement their preferred workflow, visual displays, data structure, email cadences, task checklists, underwriting strategies, application forms and much more. Each application you process will always be connected to a single loan product.

Loan products enable no-code customization of the entire loan origination process!

More specifically, loan products include the:

- Workflow statuses that applications will pass through and the user permissions for each status.

- Applicant Types that are allowed to apply for this loan product, and whether an intermediary is required.

- Lender views that let you edit the layout of application data.

- Application form for starting new applications from within the Lending System internal interface (does not apply to applications started through digital lending portals).

- Documents allow you to manage existing document features.

- Labels that can be assigned to applications, documents and tasks to provide visual categorization.

- Decision Strategies allow you to set up decision logic.

- Data Integrations allow you to set up connections with third parties.

- Calculations that should automatically run every time application data is updated.

- Automation processes that should run on applications to eliminate manual work.

- Access Permissions for the loan product on the platform and its availability on the digital lending portal.

One System. Multiple Products.DigiFi lets you manage multiple business lines in one place. Multiple loan products can be similar (e.g. different types of mortgages) or completely different (e.g. personal loans vs. mortgages).

How To Add A Loan Product

To add a new loan product:

- Click the button.

- Complete the form that appears (details are below).

- Click the button.

You will then be redirected to a detailed section to begin configuring the loan product.

| Field | Description | Example |

|---|---|---|

| Loan Product Name | The name your team members will see in the system when viewing applications for this loan product. | Preferred Plus Personal Loan |

| Loan Product Icon | An icon that will represent your loan product. | Personal Loan |

Change Log

The Change Log shows the history of changes within the selected lending product. You can see the changes, who made them and when they were made.

Updated 6 months ago