Overview of Borrower Portals

An overview of digital lending portals for borrowers.

Overview of Borrower Portals

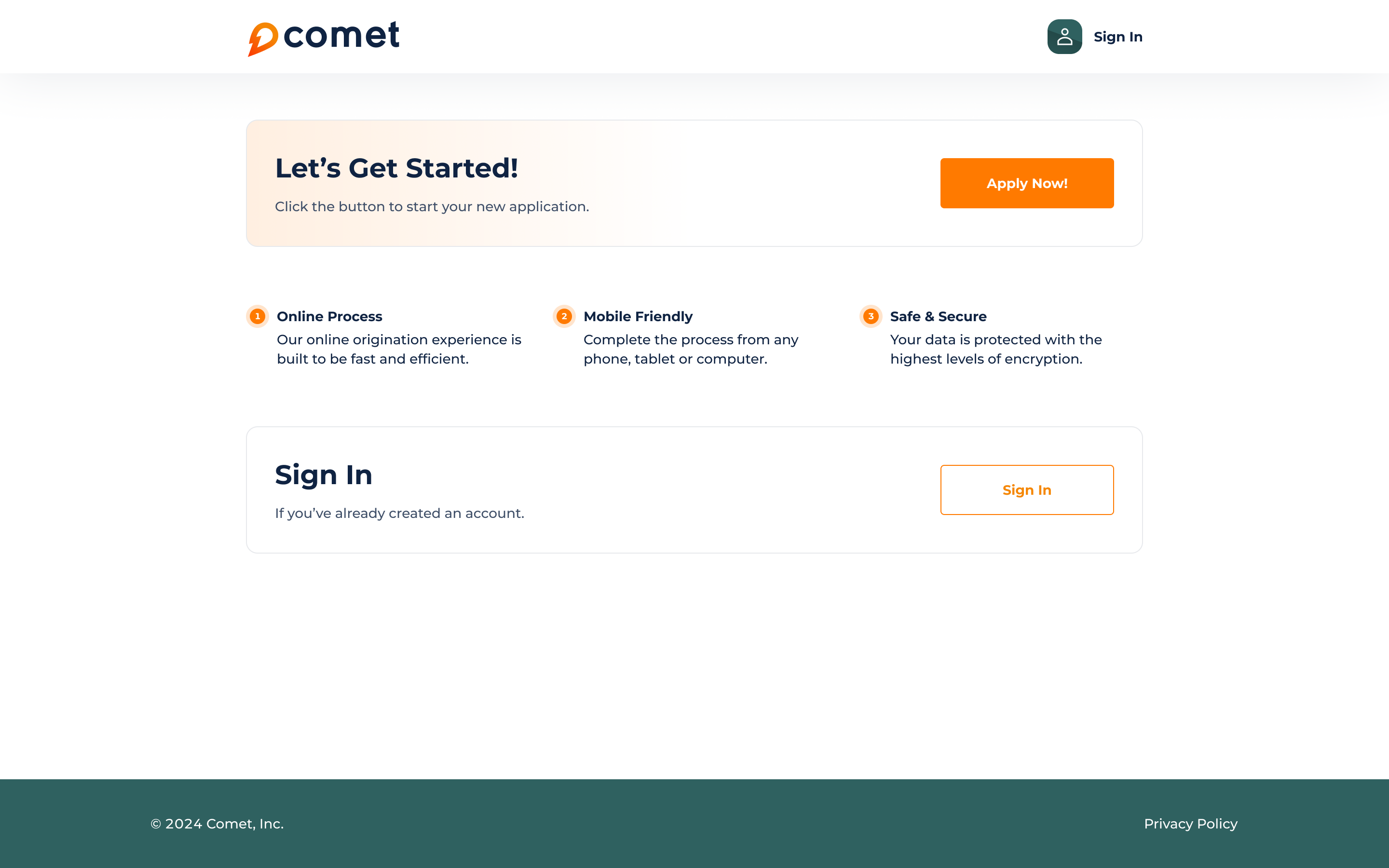

DigiFi’s borrower portals provide your customers with a modern, intuitive and branded online lending experience. They use the Borrower Portal Pages that you can configure within your Loan Products to empower a fully-customizable user journey, including the ability for applicants to submit applications, create accounts, upload documents, select offers, connect financial accounts, verify information, e-sign documents and much more.

The portals are web applications that can be launched directly from within the DigiFi platform, without any coding or technical expertise required. The portal will use your lending configurations, branding settings, custom domain and legal consents (e.g. Terms & Conditions), which can be set up in the platform to provide a seamless experience for your customers. Applications received through the borrower portal will appear in the DigiFi platform, enabling a full cycle of online application processing. In addition, the portals are optimized to be used from any device (computer, tablet, and mobile phones).

DigiFi's borrower portals let you instantly deploy a borrower-facing online lending experience with your own branding and loan products!

Testing and Production Portals

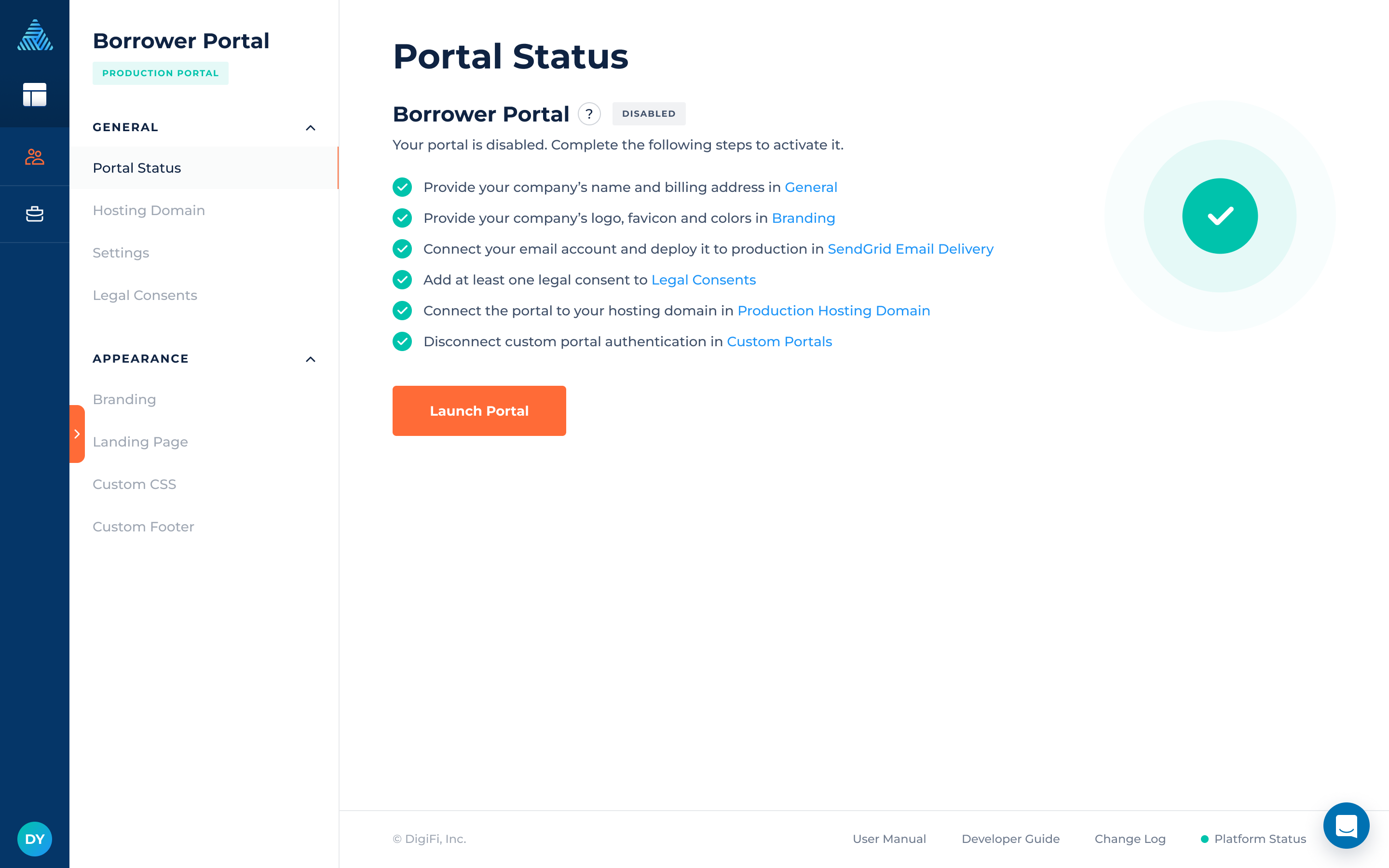

DigiFi offers a testing portal linked to the Lending System (Test) and a production portal is linked to the Lending System (Prod).

The testing portal allows you to test your entire workflow from the applicant's perspective before launching a production portal. While the launching steps are similar for both portals (testing and production), you don't need to connect your hosting domain when setting up a testing portal, which allows for a quicker launching process.

Updated 7 months ago